Cantor Exchange has a parent company named Cantor Fitzgerald that serves more than 5,000 institutional clients. Forest Park BX has a sister company named Forest Park FX that lowers trading costs for forex traders worldwide.

Traders can now enter the regulated binary options market with small accounts. Before Cantor Exchange (otherwise known as CX) began offering this option, the only way traders could participate in the market was either having large accounts or risking a large portion of their accounts on each trade.

For instance, if a trader wants to trade with the competitor of CX, (Nadex) they have to trade with $100 binary options contracts. Taking an 'At the money' trade will cost $50. CX now offers similar contracts for a very small amount of $0.50 per contract for an 'At the money' trade. The entire contract is collateralized as a $1.00 contract.

I took a survey a while back on the average account size of regulated binary options traders and found that the average account size was $500-$1,000 for the group surveyed. For a trader with a $1,000 account, taking an 'at the money' trade, he is risking a whopping 5% on each trade. This is considered an abnormally large risk in the trading realm.

Cantor Exchange offers fifty cents of risk for that similar trade. A trader with a $1,000 account can easily trade a fifty cent contract, without the worry of blowing up their account. They can also leg into positions, trade multiple strikes at the same time, and manage risk far better than with the current competitor.

Now where does Forest Park BX fit into this whole arena? This is the company that will ensure you have a quality experience trading on the exchange. Just like when you have trading questions with a stock broker, you would not want to call up the New York Stock Exchange every time you experienced an issue. Forest Park BX is there to make sure your trading is facilitated easily.

Cantor Exchange also offers free API access. The competitor, Nadex, offers API access for expensive fees. This free, open source, access will allow any trader with programming knowledge to program their own indicators and automated strategies for regulated binary options via the mt4 platform as well as any other programming they feel the need to do. This is going to open up the way for tools such as web applications, etc... to work their way all across the internet. So far, this has been limited to only the best funded traders at Nadex due to the sheer cost and capability.

Commissions are another great factor with Cantor Exchange. There are zero fees associated with market orders. Nadex charges .90 commission to open any trade. Limited orders are a penny per contract with CX.

One of the best things, since sliced bread, with Cantor Exchange is their 'rolling strikes'. A rolling strike is a strike price that opens up no matter how far the market moves. On Nadex, if the market price moves X number of pips, you can run out of strikes. If you run out of available strikes, then you can not trade, you can't manage any open positions, and you can't hedge. On CX, it does not matter how far the market moves, there will always be the available strike so you will be able to trade at any price level.

The asset range on CX is a bit limited because the exchange is growing. As they grow, so will their product lines. Currently they offer 5-6 forex pairs and gold. In the near future, oil will be offered as well as an index.

Education about trading on the exchange is also a bit limited as well but I am looking to change that in the near future. Traders will need to know and understand trading principles before jumping in. Below I will show a few very basic aspects about trading through Forest Park.

1.What is a strike price?

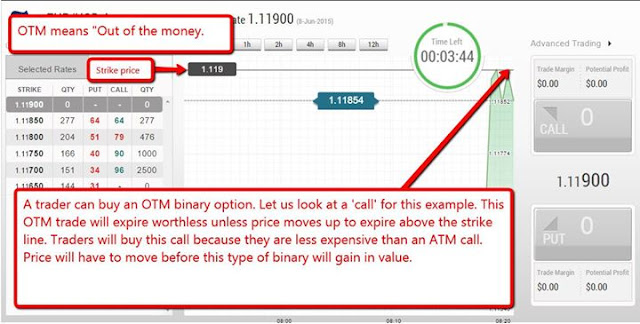

2. What is an 'out of the money' binary option?

3. What is a 'call'?

4. What is a contract expiration?

5. What is an 'in the money' binary option?

6. What is a put?

7. What does 'at the money' mean?

Above are some simple binary options terms. Stay tuned with Joaquin Trading to bring you more education in the coming days.

Here is what I have in store...

The basics of trading on Cantor Exchange via Forest Park BX.

(A video Series)

Each video will be around 5 minutes long and teach basic structure.

1. What is a binary option?

2. CFTC Regulated binary option vs. unregulated

3. How are binary options different from traditional options?

4. What is a stike price?

5. What is an expiration time?

6. What is a put?

7. What is a call?

8. What is a bid/ask spread?

9. Buying a put or call in the money

10. Buying a put or call at the money

11. buying a put of call out of the money

12. Settling in the money

13. Settling out of the money

14. Settling at the money

15. Closing early at a profit

16. Closing early at a loss

17. Legging into a position

18. Trading multiple stikes

19. What is a GTC order?

20. What is an IOC order?

21. What is liquidity?

22. What is an underlying asset?

23. What are the trading times of each asset?

24. What is hedging?

25. What is Risk Vs. Reward?

26. What is forex?

BASIC TRADING STRATEGIES

27. Trading Support and Resistance

28. Trading Trend Lines

29. Trading Standard Deviation

30. Trading a Triangle

31. Trading a Flag

32. Trading a Moving Average Crossover

33. Trading the RSI

34. Trading the News

35. Trading a Straddle

36. Trading a Butterfly

37. Trading a Binary Collar

MONEY MANAGEMENT

38. Compound Interest

39. Trade Small

40. Martingale Myth

41. Adding to a winner

42. Adding to a loser

43. Risk Vs. Reward

TRADING PSYCHOLOGY

44. Know yourself

45. Why do the majority of trader fail?

46. How to stick with a system

BUILDING A SYSTEM

47. So you want to create a trading strategy?

48. What is back testing?

49. How to Back Test

50. Why to hire a programmer

51. How to Forward Test

52. Automating your System

WEALTH BUILDING

53. Increasing your position size as your account grows

54. Tax Implications

55. Mindset for wealth

Alrighty then! That was my 2 cents worth of thoughts. See you next time and happy trading!

If you are interested in trading with Forest Park BX on the Cantor Exchange, please visit forestparkbx.com .

If you are interested in learning more about these regulated binary options and how to trade them, visit joaquintrading.com

Follow the fastest growing face book group related to Cantor Exchange. facebook.com/groups/cantorexchange